Smartnumbers Consortium

Smartnumbers uses machine learning and community to authenticate customers and prevent fraudsters from accessing information.

Opportunity

The fraud industry have many organisations that help organisations tackle fraud, however, there are many challenges ranging from compliance issues to knowing who to contact in a specific organisation.

The team

- Product Designer

- Developer

- Product Manager

- Compliance teams

Wins

Across 6 months of continued development, we saw:

- Number of prolific fraudsters increase from 250 to 961.

- 11,042 instances of granular information being loaded to the Consortium

- 18,379 numbers known to link to fraudsters.

Introducing Smartnumbers

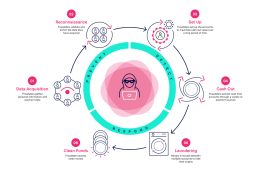

Criminals use contact centres as the weak link to carry out scams and fraud. Smartnumbers’ AI-powered platform analyses calls and helps prevent fraud before a call is answered.

There are typically 6 stages of fraud, see the image for more details.

Process

1. Investigating the data

This idea was born out of a hypothesis I had. We had a feature called “Fraudsters”. This feature only had data on a tenancy by tenancy level.

Our users created these fraudsters and there were 250 profiles to analyse for crossovers against 4 customers. Each fraudster will have multiple phone numbers linking them, and I learned Python to assess any crossovers.

These profiles contained three things – a name, a protocol (what should be done by the investigator to secure an account), and methods (what the fraudster is doing to defraud the organisation).

Outcome

52% of fraudster profiles have contacted more than one organisation. The fraud industry consistently screams for collaboration, and the enhanced intelligence already populated is valuable to other organisations protected by Smartnumbers.

2. Concept validation

Great! The value for the business and our customers is exceptional! We progress to the next step… Ensuring we can build it!

Numerous stakeholders were consulted throughout the discovery phase – Compliance, our users, Design, Product Management, and Developers. Each stakeholder plays a vital part in understanding what needs to be considered to ensure compliance.

A variety of research methods were utilised that empowered alignment across all our stakeholders. This was all completed remotely.

Outcome

The current feature is not fit for purpose and there is a significant risk of customers inputting PII in any of the free-text fields within a fraudster profile. A name, card information, or even addresses will put Smartnumbers in a tough spot.

Numerous sessions were run to test value across every stakeholder to find the “best” balance that doesn’t devalue the offering. These are considered requirements going forth.

3. Solution design

Numerous journeys were thought through, designed, and tested with all stakeholders. Compliance was prioritised as we deemed it to have the largest risk across the business.

Once internally aligned, various remote usability tests of the prototype were conducted. As we progressed further and further, the scope of work kept expanding (more on this in the next section).

Top requirements

Introducing… Smartnumbers Consortium!

The feature quickly began to expand from a small piece of work to a full value proposition that could be added to the existing platform. This is great as it has led to a product offering further increasing the business’s stream of revenue.

Smartnumbers Consortium allows organisations to compliantly share and utilise fraud intelligence without borders. This enables fraud investigators to gain intelligence they would not previously have known, and downstream systems further granularity that empowers autonomy for automated prevention strategies.

Designs

Chat

Chat is a crucial part of the journey to remediate conflicts, challenges and requests for further information.

We built PII detection before the message is sent to ensure our users are aware of any detections; these are highlighted in red.

Relevant details are presented to our users including case management,

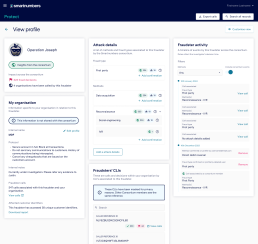

Profiles

A complete overhaul was needed to our fraudster profile page. We needed to ensure relevant information an organisation has already inputted is migrated across to avoid being lost.

I opted for a tile-based approach as we know we will expand this page to detail further intelligence. Each tile can be customised based on our users’ preferences.

→ Attack details

A brand new tile has been added that will display structured information. This information can be added directly from the profile, or a call (designs showcased below).

→ Consortium name

A new mechanism creates a global consortium name for every profile. Our users can randomly generate this.

Inline intelligence gathering

Gathering structured information plays a crucial part in success. The more intelligence we can gather, the greater the benefits to other consortium members, and our intelligence group as they have a dataset to train our models on.

The best point to capture information relating to a fraudster on a call… is a call! Once a user confirms they have sighted the fraudster on a call, they will be urged to provide information which automatically gets linked to the fraudster profile.

4. Development

It’s time to build the feature out! But it’s massive and doesn’t reach our users as quickly as we want. Everyone is excited about the release.

We sliced the work into small features that were sequenced based on enablement or value.

Existing

Organisations already have intelligence about fraudsters known to them. This is not published, and has compliance issues should this be shown to another customer.

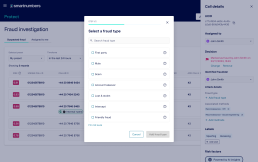

Slice 1 – Methods and Fraud Types

Utilise structured data that are known across the industry (UK Finance reporting). Focus on capturing and displaying this at key touchpoints within the investigation journey.

Slice 2 – Fraudster activity feed

Be able to see how a fraudster attacks all of our customers. This provides richer insights into active and passive threats.

Slice 3 – Fraudster’s calls

The ability to conduct deeper investigations on a specific profile tailored to calls that have entered your contact centre.

Slice 4 – Chat

Allowing organisations to communicate in a compliant way to enhance knowledge of a profile, or challenge intelligence on a profile.

Slice 5 – Automated protection

Updating the APIs to push information to downstream systems. This will allow customers to adjust their strategies with an accurate data-set.

This was intentionally left last as it will take time to develop intelligence.

5. Learn, and iterate

As every release went out to our users, we would monitor this to understand trends. These were derived from two sources; Amplitude; and the database.

Amplitude allows event tracking to know what a user is doing, and how they did it. As it’s event-based, we needed to look at the database for an accurate number.

Wins within 6 months

18,379

Known bad numbers

Lessons learnt